Many companies got sucked into the 2021 vortex of a low-interest rate environment and high multiples when they should have focused on growth and efficiency.

General Partner of ICONIQ Growth, Doug Pepper, and General Partner and Head of Analytics, Christine Edmonds, joined us for Workshop Wednesday, held live every Wednesday at 10 a.m. PST, to unveil the data behind effective scaling.

Pepper shares that ICONIQ, a venture capital firm with $10B under management, made fewer investments last year than ever before. It was a tough growth environment, but it feels like it’s changing in 2023.

A Look Back At 2022 Performance

ICONIQ Growth leverages quarterly operating and financial data from 92 enterprise SaaS companies. Using these real numbers from real companies, they have a solid insight into the long-term health of businesses.

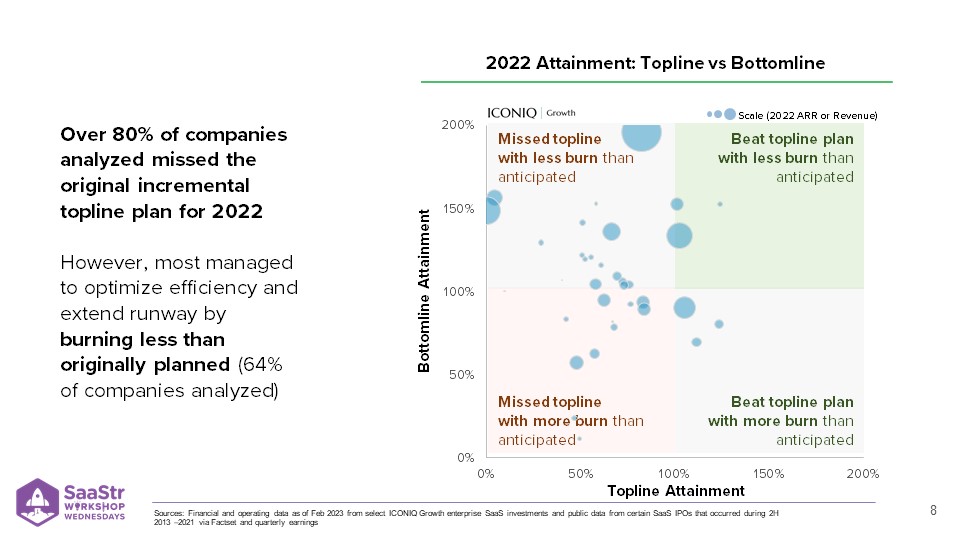

It’s not a surprise or secret that 2022 was challenging, especially starting the year with 2021 growth expectations. Of the companies analyzed, 86% missed their original incremental topline plan.

At the same time, many started the year with healthy balance sheets and used their 2020 learnings of scenario planning and applied them quickly.

While they may not have hit that topline plan, most managed to optimize efficiency and extend runway by burning less than initially planned.

The Takeaway

In today’s environment, companies need to keep a close eye on their burn multiple (how much money are you burning for every new dollar of ARR you’re adding in a given period of time?).

Actions Companies Can Take Today To Reduce Burn

Companies that have been able to beat bottom-line plans have taken various strategic actions, often in tandem, to reduce burn and extend runway. Some of those actions include:

- Reductions in force (RIF) — this one can be tough

- Hiring slowdowns and freezes — everyone seems to be doing this

- Spend reductions

- Forecasting rigor and beat & raise motion

- Changes to go-to-market strategy — many could get more efficient here

- Leveraging offshore resources

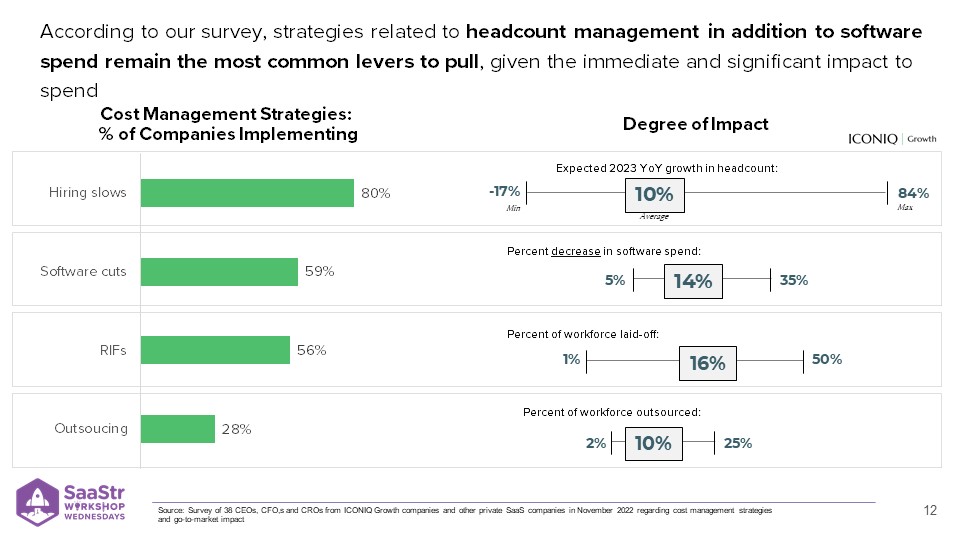

ICONIQ conducted a survey, asking their most successful companies, “What are you doing?” Many of them said headcount management and spend were common levers they pulled, given the immediate and significant impact they have on spend.

What are companies doing today to scale efficiently?

- 80% of companies are slowing hiring. Last year, many grew their workforce by 50%. This year the average is 10%.

- 59% of companies are implementing software cuts. As software lovers, this one can hurt, but it makes sense when spending too much on nice-to-have tools vs. the must-haves.

- 56% of companies are letting go of great people (RIF), with 16% of the workforce being laid off.

- 28% of companies are looking to outsource to cut costs.

It’s Time To Let Go Of Good People

If your company hasn’t done a RIF, you’re in the minority now. You better be feeling good about efficiency and runway if that’s you. It’s time to let go of good people so you’re only left with great people.

Let’s look at the stats.

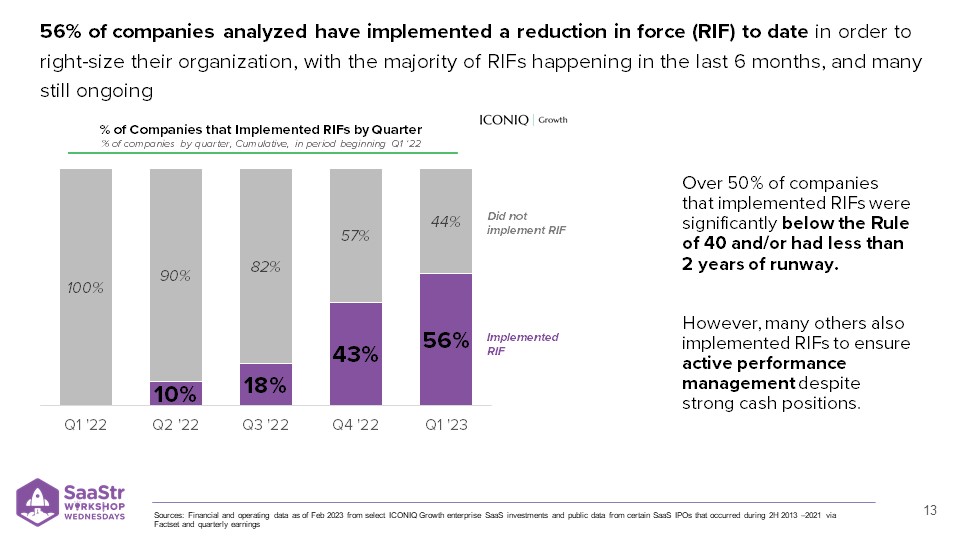

RIFs have increased quarter-over-quarter over the last five or six quarters, but with a big jump in the last two.

Why is that?

Reality set in. 56% of companies analyzed have implemented a reduction in force to right-size their organization, with the majority of RIFs happening in the last six months and still ongoing.

Out of those companies, over 50% were significantly below the Rule of 40 (a company’s combined profit margin and growth rate should exceed 40%) and/or had less than two years of runway. However, many others implemented RIFs to ensure active performance management despite strong cash positions.

This is why there’s no one-size-fits-all advice for scaling efficiently because every company is different.

People were either burning too much or wanted to expand runway, and this caused a big jump in RIFs.

Is Your GTM Strategy Poking Holes In The Ship

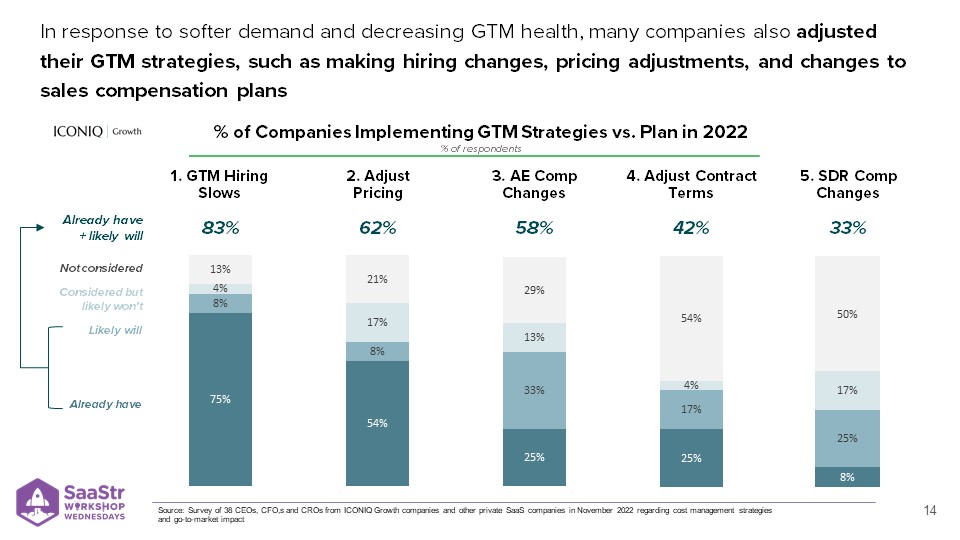

GTM strategy has been one of the biggest areas of inefficiency over the last two years. If you’re setting sail on a ship, you don’t want holes all over the place, letting water in and slowing you down.

To build resilience in GTM, many companies are cutting the least experienced people, typically the newest ones, particularly salespeople who aren’t ramped and haven’t reached attainment yet.

Some other strategies for creating a more efficient go-to-market are:

- Adjusting pricing and contract terms with customers. Companies are giving price breaks this year to reduce churn and increase retention, with the caveat that it might go up next year. Incentives for multi-year contracts are another tactic.

- AE and SDR compensation is another tactic to align GTM with what you want. Offering higher commissions for long-term contracts or generating pipeline in the highest quality vertical can drive GTM efficiency.

The Takeaway

There’s only so much you can cut. More venture activity in the second half of this year and even more next year is the most likely trajectory for building more runway.

Planning For The Rest Of 2023

This was one of the hardest years for folks to put together annual budgets that didn’t suffocate growth with efficiency but still moved toward an efficiency-minded approach.

At the beginning of 2022, most of those plans were based on the assumption that 2021 growth could be sustained — 56% year-over-year growth in revenue.

What companies actually achieve fell quite a bit short at 38%. The forecasted median growth rate is more tepid now, around 35%.

As we look to 2023, median topline growth is expected to be roughly in line with 2022 growth. However, there is a significant pivot to efficient growth with a projected improvement in margins.

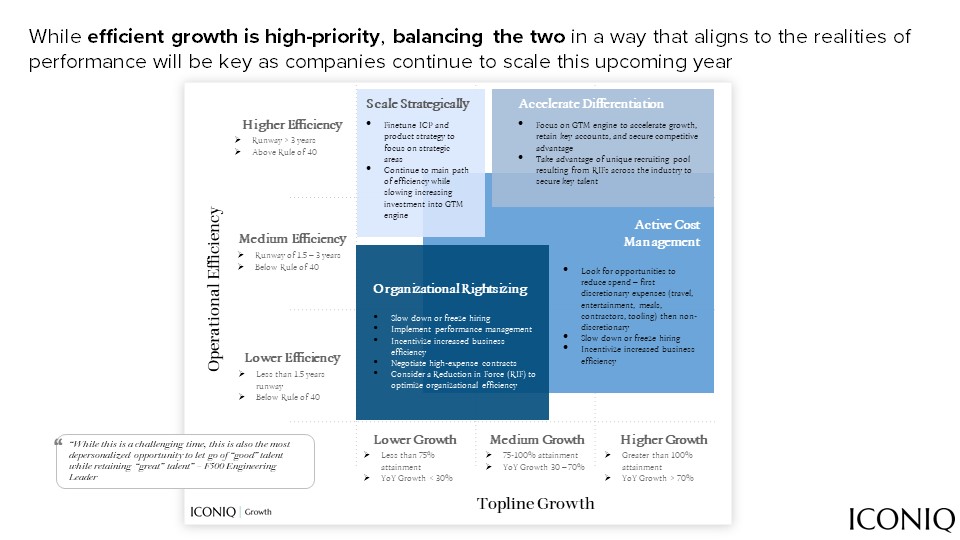

Each company will likely approach operational efficiency differently because some already have a runway greater than three years and are above the Rule of 40, while others have less than 1.5 years of runway and are below the Rule of 40.

Some of the strategies companies can focus on, depending on where they are on the spectrum of efficiency, include:

Scaling strategically

- Finetune ICP and product strategy to focus on strategic areas

- Continue to the main path of efficiency while slowly increasing investment into the GTM engine

Accelerating differentiation

- Focus on the GTM engine to accelerate growth, retain key accounts, and secure a competitive advantage.

- Take advantage of a unique recruiting pool resulting from RIFs across the industry to secure key talent

.Active cost management

- Look for opportunities to reduce spend — first discretionary expenses (travel, entertainment, meals, contractors, tooling), then non-discretionary

- Slow down or freeze hiring

- Incentivize increased business efficiency

Organizational right-sizing

- Slow down or freeze hiring

- Implement performance management

- Incentivize increased business efficiency

- Negotiate high-expense contracts

- Consider a RIF to optimize organizational efficiency

The distribution of how companies are fairing in today’s environment is totally normal. Some are killing. Some are struggling. Most are somewhere in the middle.

This might feel like an unusual time, but really, 2021 was abnormal because everyone was killing it. Now we’re back to normal.

You can find the slide deck from this presentation HERE

Every Wednesday at 10 a.m. PST, SaaStr will hold live, interactive workshops on Zoom where experts in the community share their insights. Sign up HERE!

![do-blog-posts-actually-lead-to-purchases?-[new-data]](https://seonewsmedia.com/wp-content/uploads/2023/03/20480-do-blog-posts-actually-lead-to-purchases-new-data-150x150.jpg-23keepprotocol)